The original convenience store (c-store) concept was a gas station add-on enabling consumers to grab a soda and pre-packaged snack while pumping fuel. Over the decades, it has grown into a complex retail environment serving multiple consumer needs. Modern convenience stores offer a range of products beyond fuel and snacks (see Part 2), including groceries, fresh cooked food, customizable sodas and coffees, alcohol, health and beauty products, and more.

To accommodate new offerings, c-stores have grown their real estate footprint and the size of their workforce. Effectively managing a larger employee pool, in addition to navigating retail challenges including labor shortage, changing customer expectations and regulatory mandates like predictive scheduling, requires a sophisticated, data-driven approach to demand forecasting that supports accurate and effective labor planning, scheduling and execution.

Evolution of convenience retailing

Over the past three decades, consumer demand for convenience store shopping has exploded. The industry has grown to more than 152,000 stores in 2023, according to NACS. Where before most c-stores were single-store businesses, two decades of industry consolidation have resulted in many chains with dozens of stores and some that operate hundreds and even thousands of stores. In both the U.S. and the U.K., the larger chains have become increasingly dominant, setting the industry trends and shaping and adapting to consumer shopping preferences.

U.S. c-stores are becoming all-in-one shopping destinations where customers can pick up essential frozen, fresh and pantry groceries, fill up the tank, and grab takeout breakfast, lunch or dinner. Some c-stores prepare their own fresh food, others have incorporated fast-food franchises within the four walls of the store. Increasingly, convenience stores are popping up within interstate rest areas and mass transit stations.

The unique role of convenience stores opens new opportunities to meet consumer needs

Convenience stores offer consumers a unique value proposition. In terms of speed and ease of shopping, there’s no comparison between c-stores and traditional grocers or quick-service restaurants. NACS Speed Metrics Research revealed that customers come inside, choose items, pay for them and depart a convenience store in just three to four minutes. This short duration between entering the store and completing checkout means stores must be optimally staffed and prepared to deliver efficient customer service across a variety of areas.

Customers count on convenience stores for:

- The first cup of coffee that carries them through their commute to work

- A quick stop for fuel and a consistent food experience when they are traveling

- A convenient place to pick up takeout dinner on a hectic day

- The closest source of essential groceries in many rural towns and urban food deserts

As stores continue to level-up based on consumer demand for healthier fresh foods, a wider selection of mini-grocery offerings, barista-level coffee, and more, their operational complexities expand in parallel. These innovations provide important opportunities to grow the business and open new revenue streams, and c-stores are now competing directly against traditional grocers and quick-serve restaurants for a greater share of consumer spending. However, success with these expanded offerings requires that c-stores equip themselves with the ability to manage and schedule the additional people and activities needed to support them.

Leveling-up requires a new labor model

Offering new products and services means convenience stores must expand labor budgets and hire and train more employees. Beyond the traditional three employee tasks of stocking, cashiering and cleaning, the new model of expanded operations depends on an expanded staff trained in how to bake donuts, make pizzas and chicken tenders, tend to a coffee bar, and maintain food safety.

Traditionally, a small c-store might only need one or two employees per shift. Today’s operations might require several people during busy times, and managers need to match employees with the right skills to the tasks at hand. For example, you might only need cashiering and stocking at midnight on a Tuesday. Fast forward to 12 am Saturday in a college town with a home football game, and you may need a whole team of pizza and snack cooks to keep up with demand for late-night treats.

Accurate demand forecasting provides the foundation to effectively plan, schedule and execute store operations

C-stores must be able to forecast customer traffic as well as peak demand for fresh-cooked items with great precision. Better forecasting will ensure stores schedule the right team members at the right times to satisfy customer demand. It also helps avoid food waste by ensuring employees cook the right amount of food to fill customer demand quickly while avoiding spoilage.

Before creating a schedule, store managers need to forecast what will happen in the coming weeks. This includes predicting sales volumes at the item level and preparing for the associated workload at the task level. The accuracy of these forecasts will drive both inventory management and labor management for the store.

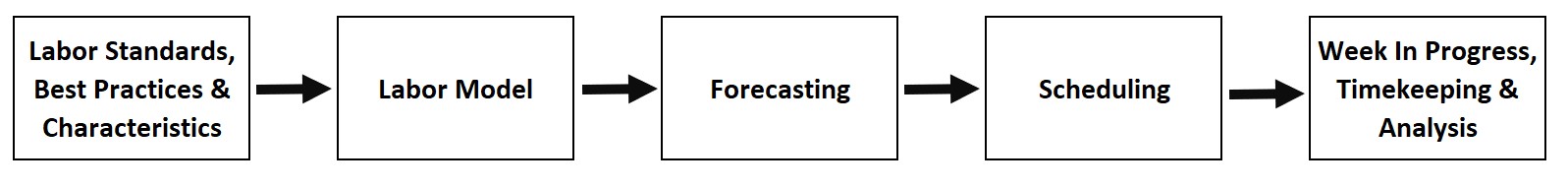

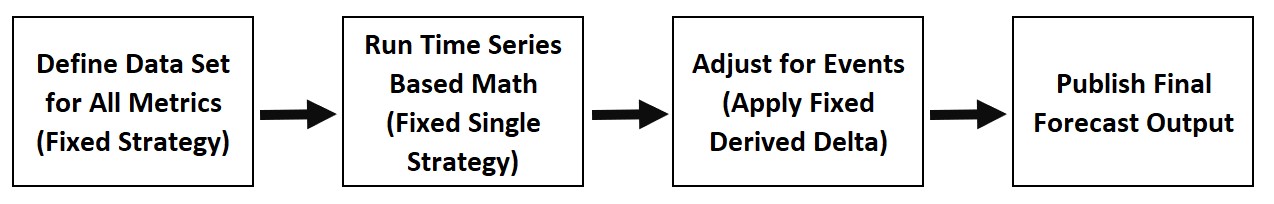

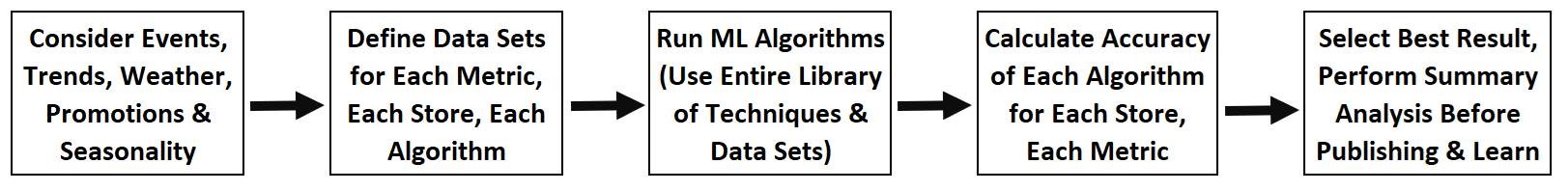

Advanced AI forecasting technology helps c-store operators optimize scheduling and contain labor costs while ensuring an excellent customer experience. The best solutions produce multi-dimensional, multi-layered forecasts that project demand based on historical sales and additional aspects like weather, holidays and seasonality that all impact foot traffic. With an understanding of demand and precisely what work needs to be done, a good forecasting solution works with labor modeling and labor standards inputs to understand how much time it takes to perform specific tasks, like stocking a shelf, preparing a pizza, refilling the soda machine, and baking the donuts, and how many people are required at what times for adequate coverage. The resulting forecast predicts the times of day and number of repetitions these tasks will take place.

Integrated with state-of-the-art scheduling capabilities containing advanced AI logic driving compliance with rules, availability, priorities and more culminates in a schedule with the right amount of task coverage by people with the documented skills to perform those tasks. And to meet the expectations of today’s connected workforce, communicating both schedules and tasks to staff through a mobile interactive employee portal that provides work assignments, task guidance and enables self-service activities like changing availability, bidding on or swapping shifts further facilitates both operational effectiveness and employee satisfaction.

A demand forecasting solution that produces a reliably accurate baseline forecast weeks in advance and subsequently refines that forecast via continuous reforecasting over time based on real-time information not only improves operational results, but can also ultimately translate into better recruiting and retention results by helping c-stores offer more flexible and predictable schedules. Pinpointing the number of people and skills needed for any shift well in advance facilitates schedule building and advance communication of employee schedules to help comply with Fair Work regulations and predictive scheduling rules. Automated scheduling and self-service further enable stores’ ability to generate highly accurate task-level schedules while streamlining and honoring employee preferences, communication with managers and peers, shift changes, job resources and more.

In closing

Convenience stores have come a long way since their pared-down origins, and their expanded breadth of offerings has translated into more complicated staffing and operational needs. An expanded labor model and sophisticated AI demand forecasting integrated with powerful AI scheduling logic and task management capabilities set the foundation to optimize operations and create positive employee and customer experiences. As convenience stores continue to evolve, successful operators will leverage these advanced technologies to streamline labor planning, scheduling, tasks and store execution while enhancing profitability and competitive edge.