Executive Summary: The Slowest Holiday Growth Since 2009—But Still an Opportunity

The 2025 holiday season is arriving in unprecedented territory: economic uncertainty, tariff headwinds, and consumer caution are converging to create the slowest holiday growth forecast in over 15 years. Yet beneath this challenging headline lies a paradox that savvy retailers are seizing.

The Numbers Tell the Story:

- $5.42–5.48 trillion in total retail sales expected (2.7–3.7% growth) - National Retail Federation, 2025 Annual Retail Sales Forecast

- $253.4 billion in online sales (November–December), up 5.3% year-over-year - Adobe Analytics, 2025 Holiday Shopping Season Report

- First trillion-dollar holiday season in digital commerce - Adobe Analytics

- 56.1% mobile revenue share, the highest on record - Adobe Analytics, 2025 Holiday Shopping Season Report

- Consumer spending decline of 5% on average—the first notable drop since 2020 - PwC Holiday Outlook 2025

2025 will have some challenges, but retailers who optimize operations, manage costs strategically, and plan inventory intelligently are still winning. With Black Friday days away, use these early-season insights to build your 2026 playbook now.

The Peak Shopping Window Is Narrowing—And Starting Earlier

Key Shopping Patterns for 2025

The Early Bird Advantage:

- Two-thirds of consumers (66%) plan to start their holiday shopping before Black Friday, fundamentally changing the peak season timeline. This represents a dramatic shift in when retailers capture demand. - McKinsey ConsumerWise, August 2025

- September–October: 37% of gift buying will occur (vs. 32% November–December) - Industry analysis based on McKinsey and eMarketer data

- Cyber Monday inflection: Nearly 80% of holiday gift spending will happen before Cyber Monday - Adobe Analytics

- Boxing Day (UK): Re-enters the top five busiest shopping days in 4th place, signaling strong post-Christmas demand - British Retail Consortium

Peak Day Implications:

The compressed but front-loaded shopping season means that retail operations teams need to:

- Staff up during September–October rather than the traditional November peaks

- Ensure inventory is positioned and accessible earlier

- Launch marketing campaigns in late August (not September)

Mobile and Social Commerce Dominance

Mobile is no longer a secondary channel—it's the primary driver:

- 56.1% of online revenue will come from mobile - Adobe Analytics, 2025 Holiday Shopping Season Report

- 7 in 10 retail site visits occur on mobile devices - Adobe Analytics

- 21% of shoppers used social media to purchase holiday gifts (jump from 12% in 2024) - Industry analysis; Basis Technologies, 2025 Holiday Shopping Preview

Implications for frontline teams: In-store associates must be equipped with mobile tools for inventory lookups, price matching, and seamless BOPIS (Buy Online Pickup In Store) workflows.

Operational Challenges—The Frontline Crisis

The Staffing Crisis: Lowest Holiday Hiring in 15+ Years

The numbers are stark:

- Total holiday hiring expected to fall below 500,000 positions (the weakest seasonal employment gains in 15+ years) - Challenger, Gray & Christmas, 2025 Holiday Staffing Forecast

- 68% of retailers anticipate higher operating costs despite hiring fewer people - Industry surveys, 2025

- Retail turnover rate remains at 24.9%, meaning aggressive competition for talent - Bureau of Labor Statistics, 2025

Why retailers are hiring less:

- Tariff uncertainty: Economic uncertainty is forcing retailers to delay hiring decisions for flexibility

- Technology acceleration: Automation and self-checkout systems are replacing some seasonal roles

- Cost pressures: With tariffs eating into margins, many retailers are forcing existing staff to stretch further

The Hidden Cost: Quality Service Under Pressure

This creates a dangerous dynamic: fewer staff managing higher volumes, customer expectations, and complexity.

Risk factors:

- Longer wait times and lines at checkout

- Reduced quality on frontline service (customer satisfaction declining)

- Increased pressure on existing employees (burnout, turnover acceleration)

- Missed sales opportunities due to inadequate floor coverage

- Higher shrink rates and compliance risks with skeleton crews

For operations teams: This is a critical moment to invest in workforce scheduling, task management, and productivity tools. Smart scheduling and staff optimization can be the difference between a profitable season and a chaotic one.

Labor Costs and Wage Pressures

- Seasonal workers are becoming harder to attract, leading to wage increases

- Existing staff are demanding higher pay or threatening to leave

- Training burden is intensifying as quality workers are harder to find

- Compliance risks increase with less experienced staff

Tariffs Are Already on the Shelf

The $907 Billion Problem

Consumer expectations are clear: 77% believe tariffs will drive up prices, and 8 in 10 are planning to cut back spending.

Where tariffs are hitting hardest:

- Apparel & Footwear - Among the most impacted categories

- Tech & Electronics - Price increases are visible at scale

- Toys - Major price increases expected

- Home Goods - Examples like IKEA seeing $90+ price jumps on single items

The pass-through calculation:

- $907 billion in tariff costs to large retailers - S&P Analysis, 2025

- $592 billion (approximately 2/3) being passed to consumers - S&P Analysis

- Rest of impact: Eaten by retailers through lower margins

Consumer Response: Caution and Deal-Hunting

- 84% of consumers expect to cut back general spending over the next six months

- 47% of holiday gift buyers will buy fewer gifts or spend less due to tariff concerns

- 73% of UK shoppers plan to spend more time searching for gift deals

- 23% of UK shoppers have already started shopping early to find bargains

Strategic implications: Retailers need to communicate value and emphasize deals early. The narrative of rising prices is already in consumers' minds—transparent, early promotions can capture share before competitors do.

Financial Reality—ROI Constraints in a Constrained Holiday Season

The Budget Allocation Challenge

Conservative expectations: Over 50% of retailers expect either flat revenue or growth of 10% or less in 2025 versus 2024.

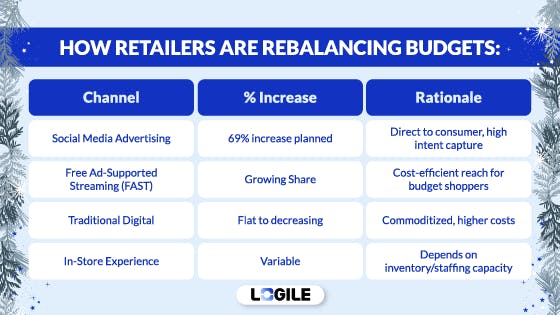

Advertising Spend Distribution Across the Season

Traditional wisdom no longer applies. With 37% of spending occurring in September–October:

- September–October: Allocate 40–45% of annual holiday budget

- November (Pre-Thanksgiving): Allocate 25–30%

- Black Friday–Cyber Monday: Allocate 15–20%

- Post-Cyber Monday through December 20: Allocate 5–10%

Amazon and Walmart have already moved: Both are heavily promoting October sales, signaling that the traditional November peak is fragmenting.

Operational Cost Pressures

68% of retailers are facing higher operating costs:

- Logistics: Shipping costs remain elevated; BOPIS mitigates this

- Labor: Fewer seasonal hires but higher per-person costs

- Inventory carrying costs: Stocking more inventory earlier to avoid tariff exposure

- Technology: Investment in omnichannel systems to manage BOPIS, mobile fulfillment, etc.

Inventory Intelligence—Stock Smart, Not Just More

The Paradox: Low Stock Concerns Amid Caution

57% of retailers report low stock as a moderate-to-severe problem, yet consumer spending is expected to decrease. This creates inventory risk on both ends: understocking during peak demand and overstocking on slower items.

Returns Management: A Brightening Spot

The good news: Only 6% of retailers consider returns a severe problem, down from 49% in 2023.

The risk: 75% of retailers report that return fraud worsens during the holidays, primarily:

- Shoplifted goods being returned for refund

- Used-but-non-defective items

- Fraudulent tender

Strategic Inventory Recommendations

1. Front-load inventory (September–October):

- Place orders well before the peak to lock in pre-tariff pricing

- Use historical data to forecast demand by product category

- Build in buffer stock for high-velocity items

2. Plan for 2x return volume post-holidays:

- Designate space and resources for returns processing

- Implement returns management software

- Create holiday-specific return policies with clear communication

3. Leverage BOPIS to reduce inventory complexity:

The BOPIS boom is real:

- 97.2 million Americans regularly use BOPIS (34.2% of U.S. consumers) - Capital One Shopping Research, May 2025

- $154.3 billion in click-and-collect sales expected in 2025 (up 16.2% YoY) - Industry Analysis

- BOPIS accounted for 25–28% of online orders during peak post-Cyber Monday period - Industry data

- 1/3 of all online orders will be BOPIS during the ground shipping window closure - Adobe Analytics

Key insight: BOPIS drives store traffic and incremental purchases. 85% of BOPIS shoppers make additional purchases when they collect their order.- Capital One Shopping Research

Regional Inventory Adjustments

North America:

- Traditional Black Friday momentum (but earlier)

- Thanksgiving gifting surge (November 27)

- Cyber Monday spike (extended through December 2)

UK Market:

- Boxing Day (December 26) is re-emerging as major shopping occasion

- Earlier seasonal shopping (September–October Black Friday previews)

- Compact shopping window (mid-November to end-December)

- Different returns patterns (Boxing Day returns are significant)

Key Data Points for Planning

The Generational Shopping Split

Baby Boomers are spending UP:

- +5% compared to 2024

- More likely to gift family members

- Higher average transaction values

Millennials are FLAT:

- Down just 1% YoY

- Allocating 62% of spend to family gifts

- Price-sensitive but loyal to preferred brands

Gen Z is STRATEGIC:

- Smaller budget overall, but highly intentional

- 39% of spend directed to self-gifting

- Highly influenced by social media recommendations

Product Category Winners

Expected to drive holiday spending:

- Toys, video games, consoles - Strong demand, high tariff impact

- Electronics & tech - Premium positioning but price-conscious consumers

- Home & furnishings - Gift-giving momentum despite tariff pressures

- Fashion & footwear - Heavy tariff impact will be visible

The Festive Fun Stats (For Engagement Content)

- 95% of Americans will celebrate with chocolate and candy

- $7 billion in confectionery sales expected during holidays

- Half of Americans will decorate with candy canes (2.75B candy cane market)

- 56% prefer turkey on holiday tables (52% prefer ham)

- Millennials & Gen Z driving growth in vegetarian/vegan holiday options

The Omnichannel Imperative

BOPIS Is The Operational Linchpin

Why BOPIS matters more than ever in 2025:

- Shipping deadlines are real: Ground shipping window closes mid-December (orders must be placed by Dec 20 for Christmas delivery)

- Consumers know this: One-third of online orders will be BOPIS during the critical final weeks

- It drives store traffic: 48% of BOPIS customers use it to avoid shipping fees

- It drives incremental sales: 85% buy additional items in-store during pickup

Omnichannel Expectations

Consumers now expect:

- Real-time inventory visibility (online and in-store)

- Flexible fulfillment (BOPIS, ship-from-store, curbside pickup)

- Mobile-first experiences (lookup, reserve, pay)

- Seamless returns (return in-store items bought online, vice versa)

Technology Stack Priorities

Essential for 2025 success:

- Workforce scheduling and task management (manage fewer people doing more)

- Mobile fulfillment tools (in-store staff equipped with mobile devices)

- Inventory visibility systems (real-time stock accuracy across locations)

- BOPIS/omnichannel orchestration (efficient order-to-pickup workflow)

- Returns management software (fraud detection, restocking automation)

Regional Deep Dive: North America vs. UK

North America: The Traditional Peak Still Exists (But Earlier)

Calendar focus:

- October: Early promotions and catalog releases (Amazon Prime Day influence)

- November 27: Thanksgiving Day (shift to "Giving Tuesday" peak)

- December 2: Cyber Monday (extended through December 6-9)

- December 20: Final ground shipping cutoff

- December 25: Christmas

Staffing reality:

- Thanksgiving and Cyber Monday are the critical peaks

- Earlier staffing needs in September–October

- Extended hours during November–December (but not as intense as traditional model)

Inventory strategy:

- Frontload to September–October to beat tariffs

- Aggressive December clearance for post-holiday (January returns processing)

- Plan for strong demand from baby boomers (higher spend demographics)

UK Market: A Different Calendar, Similar Pressures

Calendar focus:

- October–November: Early Christmas shopping begins

- December 26 (Boxing Day): Fourth-busiest shopping day, major retail event

- January: Significant returns and exchanges

UK-Specific factors:

- Forecast growth: 3.2% for six-week festive period (mid-November to end-December)

- Sales volume declining slightly (-0.3%) for first time since 2023

- Online growth outpacing offline: +4.7% online vs. +2.3% offline

- Mobile dominance: 56.1% of online revenue from mobile (same as North America)

Inventory implications:

- Boxing Day is a planned shopping event (not just returns day)

- Stock accordingly for post-Christmas demand surge

- Manage returns more carefully through January (different return window patterns)

Staffing reality:

- Fewer seasonal hires in UK market as well

- January returns processing is more significant (plan accordingly)

- Thanksgiving holiday advantage gone (different timing)

The Logile Imperative—Solving the Operational Challenge

The Core Problem: Doing More with Less

The 2025 holiday season will test operational excellence like never before:

- Fewer staff

- Higher expectations (omnichannel, mobile, BOPIS)

- More complex fulfillment (ship, BOPIS, in-store pickup)

- Tighter margins (tariff pass-through constraints)

Where Logile Solutions Drive Value

1. Workforce Scheduling & Optimization

- With 500K fewer seasonal hires, every person must be scheduled for maximum impact

- Peak times require frontline staff equipped with technology (mobile tools)

- Evening and weekend staffing must be precise (labor cost control)

2. Frontline Task Management

- Ensuring you have the proper staffing to manage BOPIS fulfillment, shelf stocking, inventory accuracy, customer service

- Real-time task orchestration ensures critical functions aren't missed

- Inventory accuracy (for BOPIS feasibility) requires daily accountability

3. Inventory Visibility & Fulfillment Orchestration

- BOPIS success depends on accurate, real-time inventory data

- Ship-from-store and omnichannel must be supported by visibility systems

- Returns processing needs to be automated and tracked

4. Operational Analytics & Insights

- Labor productivity metrics (staff-per-transaction, task completion rates)

- Peak time management (peak hour staffing vs. actual need)

- Inventory turn and accuracy metrics

- Customer wait times and satisfaction correlation

The Financial Case for Operational Excellence

Retailers investing in frontline operations see:

- 5–10% improvement in labor productivity

- 2–4% inventory accuracy improvement (BOPIS success rate increase)

- 3–7% reduction in operational costs (fewer wasted hours, fewer errors)

- Higher customer satisfaction (shorter wait times, better service)

Action Plan for Holiday 2025

November:

- Manage Thanksgiving holiday staffing

- Prepare for Cyber Monday peak and extended window

- Monitor tariff-sensitive category performance

- Prepare returns infrastructure for post-Cyber Monday volume

December:

- Maximize BOPIS during shipping cutoff window

- Manage post-Christmas returns surge

- Maintain service quality during peak demand

- Begin planning for January returns processing

Post-Holiday (January 2026)

- Capture operational learnings and metrics

- Implement returns processing efficiently

- Conduct staff retention and training review

- Plan 2026 improvements based on 2025 performance

Conclusion: Opportunity in Adversity

The 2025 holiday season is not a year to simply survive. It's a year to compete on operational excellence.

Retailers who win in 2025 will:

- Embrace the earlier peak (September–October readiness)

- Invest in frontline operations (fewer staff, smarter scheduling)

- Master omnichannel (BOPIS, inventory visibility, mobile fulfillment)

- Control costs strategically (labor, inventory carrying, logistics)

- Use data to drive decisions (peak timing, inventory turns, staff productivity)

The retailers who lose will:

- Be caught flat-footed by September peaks

- Staff inadequately (long lines, poor service, missed sales)

- Fail at BOPIS and omnichannel (lost efficiency, customer frustration)

- Get buried by inventory mistakes (excess stock or stockouts)

The choice is clear. The time to prepare is now.

Sources:

- Adobe Analytics - 2025 Holiday Shopping Season Report

- National Retail Federation (NRF) - 2025 Annual Retail Sales Forecast

- McKinsey ConsumerWise - Holiday Shopping Behavior Analysis (August 2025)

- PwC - Holiday Outlook 2025

- Challenger, Gray & Christmas - 2025 Holiday Staffing Forecast

- Capital One Shopping Research - BOPIS and Consumer Behavior Studies (May 2025)

- S&P Analysis - Tariff Impact Assessment 2025

- Deloitte Consumer Pulse Survey - September 2025

- Bureau of Labor Statistics - Retail Turnover Data 2025

- British Retail Consortium - UK Holiday Shopping Analysis

- Basis Technologies - 2025 Holiday Shopping Preview

- National Confectioners Association - Holiday Confectionery Data

Download the Full Report

We are retail experts, including many retail operators. We are technology innovators, with expertise in AI and machine learning. Our suite of unified store solutions connects retailers and their associates – helping them run great stores.

Recent Posts

How Technology Enables Retailers to Invest in Community-Centric In-Store Experiences

2026-01-05

Community programs need operational precision to succeed. See how Lowes Foods' Community Table thrives with AI-driven labor planning that creates capacity for connection.

Read More

NRF 2026 Guide: Top Trends Shaping the Future of Retail and What to Expect From Logile

2025-12-15

Logile celebrates 20 years at NRF 2026 with AI-powered workforce solutions. Visit Booth #4849 & #1503 to see how connected operations drive retail success.

Read More

UK Retail Budget 2025: What Retailers Need to Respond to Now

2025-12-02

The 2025 UK Budget is reshaping retail economics. Rising labour costs, higher rates, tighter margins—here's what retail leaders must prioritize now.

Read More