79% of Respondents Worry About Food Contamination or Spoilage at C-Stores

New survey from Logile reveals which convenience store foods shoppers trust, what they avoid, and how c-stores can close the fresh food quality and safety gap.

In a rapidly evolving industry, convenience stores (c-stores) are pouring resources into fresh food programs. What was once a quick stop for snacks and fuel is now becoming a direct competitor to fast-food chains, offering fresh meals, premium coffee and budget-friendly bundles. But one challenge remains: earning the trust of everyday consumers.

According to the National Association of Convenience Stores (NACS), most convenience stores sell fuel, and these stores account for approximately 80% of all motor fuel sold in the United States to consumers. Many shoppers recognize that c-store—or “gas station”—food has improved in both quality and variety, and perceptions are changing to increasingly embrace the convenience of more food items at these locations. Still, some hesitation lingers. What cues make people feel confident enough to buy? What turns them away? And can better store conditions, clear labeling, and operational technology shift those behaviors?

To explore these questions, Logile partnered with the third-party survey platform Pollfish to survey 1,000 U.S. adults about their perceptions and experiences with food from convenience-store-with-fuel operations. The findings are revealing. While many consumers held strong preconceptions regarding what they’re willing to eat, they also expressed openness to trying more options if clear cues like cleanliness, food safety, freshness and technology-driven standards are present. The 2025 Logile Convenience Store Food Quality & Safety Report uncovers the red flags, trust-building signals, and operational gaps that stand between skepticism and sales. By prioritizing enabling technology, visible cleanliness, well-trained staff, and evident indicators of freshness and safety, c-stores will be poised to drive growth and expand fresh food customer sales and loyalty.

Key Survey Findings

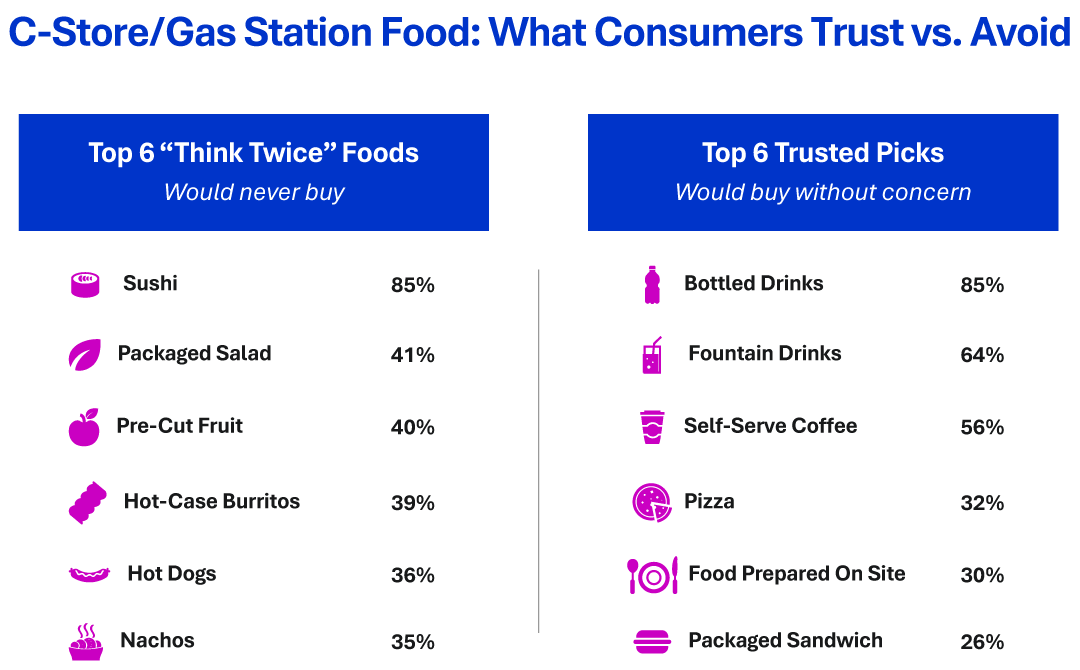

- 85% of respondents say they wouldn’t buy sushi from a “gas station” or convenience store. Packaged salads (41%), pre-cut fruit (40%), hot-case burritos (39%), and roller-grill hot dogs (36%) are also high on the “think twice” list.

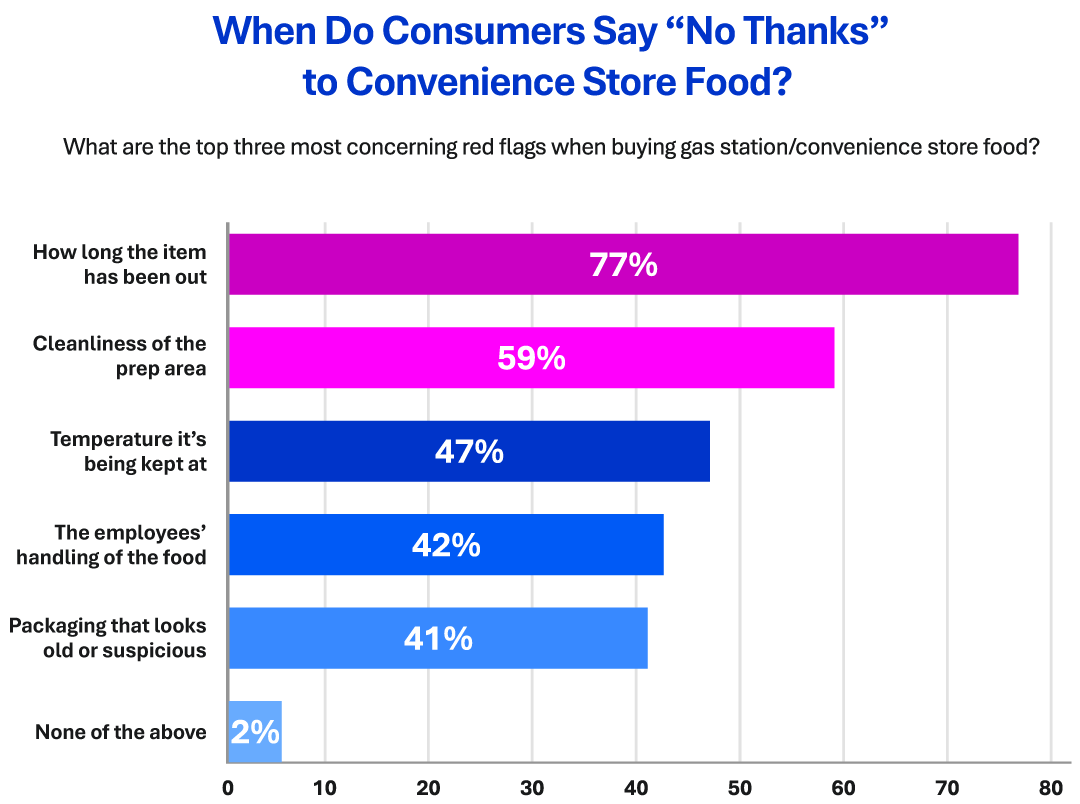

- 77% say food that’s been sitting out too long is a dealbreaker, and 59% won’t touch anything if the prep area looks dirty. More than half (56%) have walked away from a purchase after seeing an unclean machine or service station.

- 74% trust gas station or convenience store food safety less than restaurant food safety, and only 9% feel highly confident eating food from a gas station or convenience store.

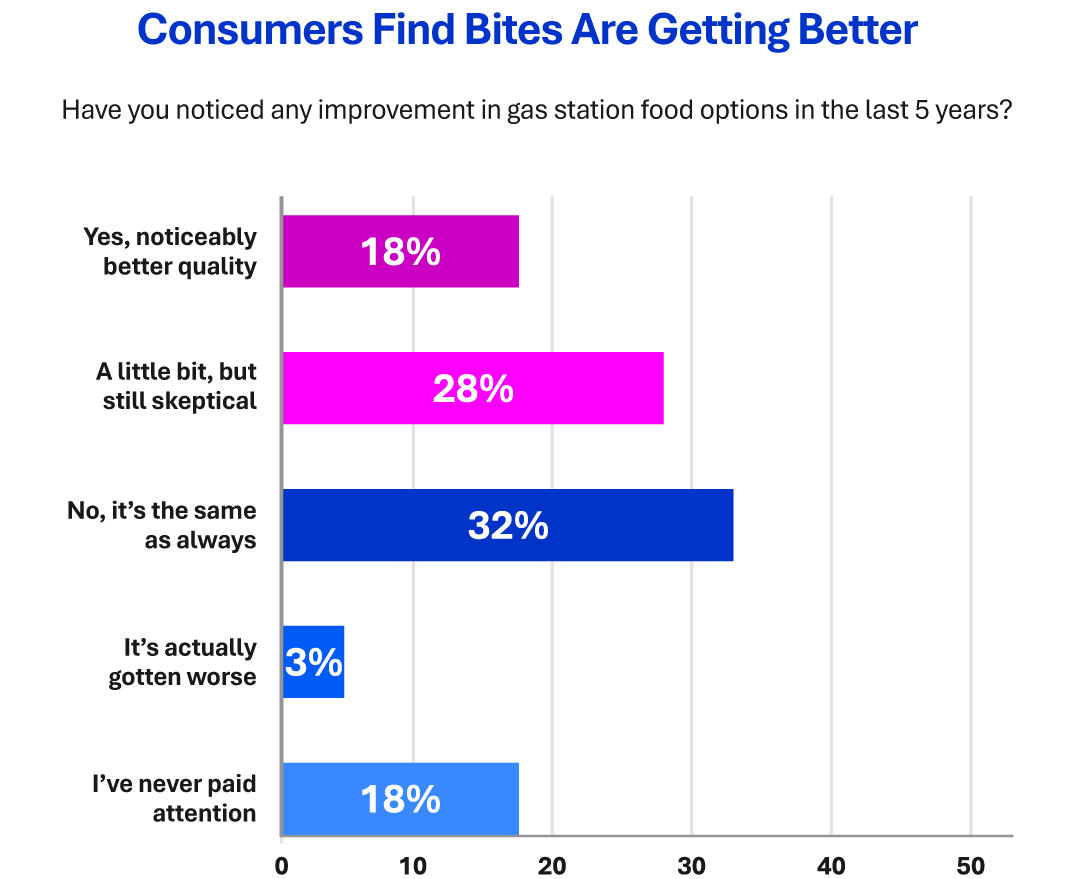

- 53% think gas station food has gotten better over time and 18% say the quality has noticeably improved. But just 10% have had consistently positive experiences.

- In order to make a purchase, 67% want to see signs that food is freshly made, 62% look for overall cleanliness, and 54% check packaging for freshness or prep-time labels.

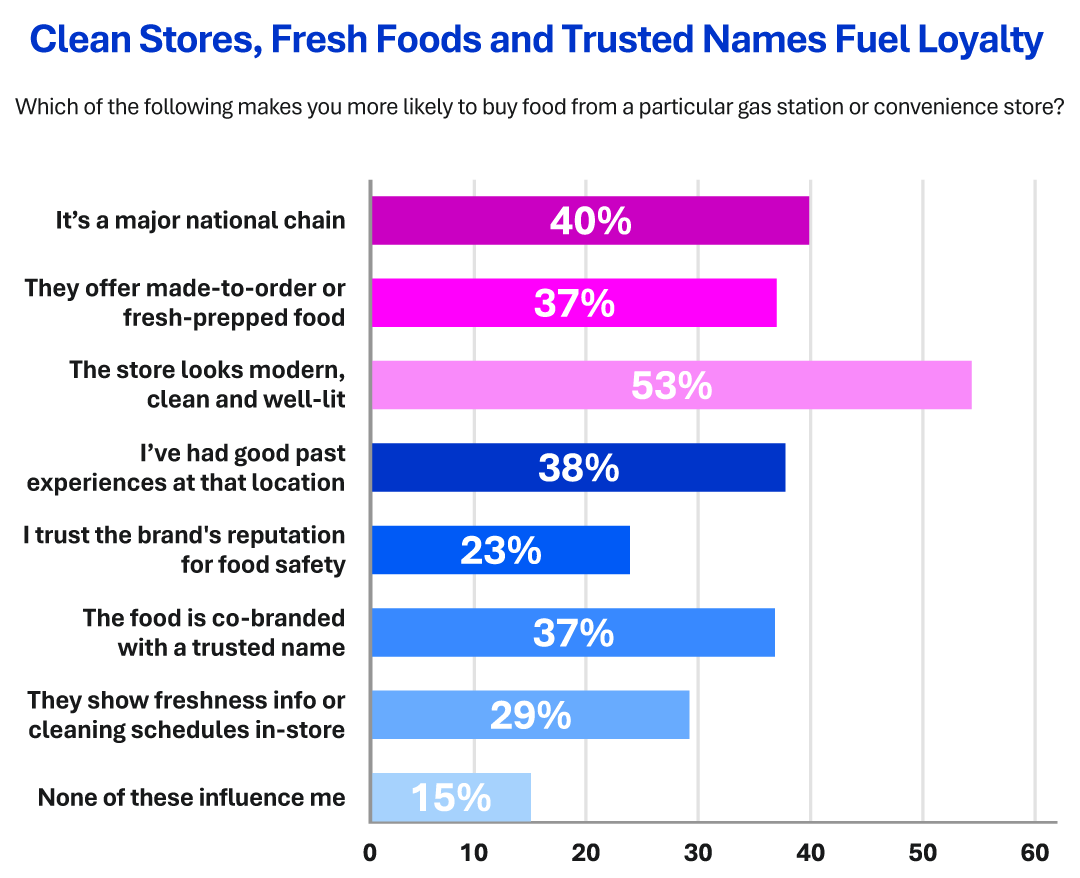

- 40% are more likely to buy food from major chains, 37% say they trust co-branded items more, and 53% are swayed by a modern, well-lit store.

- 33% say they’d be more likely to buy if cleaning or food rotation schedules were visible in-store. Another 40% say tech-enabled safety systems would boost their trust, but only if they see clear signs the store is following procedure.

The “Think Twice” List: The Foods Consumers Question Most

Some food items raised concerns for many respondents. Leading the “think twice” list by a wide margin is sushi: 85% of respondents said they would never purchase it from a gas station or convenience store. Respondents were also skeptical about pre-made packaged salads (41%) and pre-cut fresh fruit (40%). Hot-case burritos and taquitos (39%), roller-grill hot dogs (36%), and nachos (35%) rounded out the top six most-avoided items.

The top reasons for opting out paint a clear picture of consumer mindset. Two-thirds (66%) cited fear of spoiled food, 59% were concerned about cleanliness, and nearly half (48%) were worried about food poisoning. Comments from respondents suggest that visual cues, like how clean the prep station looks or how long an item appears to have been sitting, play a major role in their decision making. Foods that are cold but not sealed, warm but not freshly made, or served from machines that look poorly maintained tend to trigger the most doubt.

The “Comfort Zone” List: The Foods Consumers Trust Most

On the flip side, some items are seen as safe bets, especially when they’re sealed, simple or familiar. Bottled drinks top the list, with 85% of consumers saying they’d buy them without hesitation. Fountain drinks (64%) and self-serve coffee (56%) also inspire relatively strong confidence. When it comes to food, pizza (32%) and items prepared on-site like sandwiches and bowls (30%) are among the options people feel good about grabbing, especially when they look freshly prepared. Even pre-packaged sandwiches, while not universally loved, are trusted by a quarter of shoppers (26%).

How Cleanliness Impacts the Sale

Concerns about lack of freshness and cleanliness aren’t just driving food avoidance. They’re fundamentally shaping how consumers evaluate the full c-store food experience. 79% of respondents said they worry about food contamination or spoilage at convenience stores, with many saying those fears have shaped their purchasing decisions.

When asked about red flags that would make them question whether food is safe to eat, 77% of respondents said they’re wary of items left out too long. More than half (59%) pointed to dirty prep areas as a major warning sign, and 47% flagged incorrect food temperature as a dealbreaker. These top concerns speak directly to visible, tangible signals that shoppers rely on when deciding whether to trust food quality in convenience settings.

These concerns don’t just live in theory. They’re affecting real behavior. Over half of the surveyed consumers (56%) say they’ve walked away from a food or drink purchase after seeing an unclean machine or service area. Whether it’s a slushy nozzle crusted with syrup or a grimy microwave, small details are enough to stop a sale in its tracks.

Trust in convenience store food safety also lags behind traditional foodservice sources: nearly three-quarters of consumers (74%) say they trust gas station or convenience store food safety less than restaurant food safety, suggesting that the gap isn’t just about what’s served. It’s really about the environment it’s served in.

Hot Dog Hope: C-Store Food’s Reputation Is Gaining Ground

There’s good news for convenience retailers growing their foodservice offerings: many consumers have noticed improvements in recent years. According to the survey, 53% of respondents said food safety at gas stations has gotten somewhat better over time. In fact, nearly one in five (18%) said the quality is noticeably better. These are encouraging signals that investments in operational infrastructure, food quality, packaging, processes, and employee hygiene and safety protocols are not going unnoticed.

However, skepticism remains as only 9% of respondents said they have high confidence in gas station or convenience store food safety overall. The vast majority—71%—described their trust level as only “moderate,” while nearly 20% admitted they still have little or no confidence. This lingering doubt highlights the challenges many convenience stores still face when it comes to building consumer trust, particularly in an environment where a single misstep can have an outsized impact on brand perception.

The gap between observed improvements and actual trust may come down to consistency. While 48% of consumers say they’ve had a positive food experience at a convenience store, only 10% said they’ve had consistently positive experiences.

The Trust Triggers That Nudge Shoppers to Nosh

While many consumers remain cautious about certain convenience store foods, others are open to buying. However, they want visual proof that it’s safe, clean and fresh. When asked what influences their decision to purchase food at a gas station or convenience store, 67% of respondents said they need to see signs that the food is freshly prepared. A majority (62%) look for cleanliness of the store or prep area, and 54% want visible labeling on packaging that indicates freshness or preparation time.

Beyond visual cues, trust in the broader brand matters, too. Over a third of consumers (40%) say they’re more likely to buy food from a major national chain and brands that often invest heavily in food quality and operational consistency. 37% are more inclined to purchase if the food is co-branded with a trusted name, suggesting that recognizable partners serve as quality signals. Over half (53%) say the store’s overall appearance also plays a key role in their food-buying decisions, while past positive experiences and the store's reputation for food safety influence 38% and 23% of consumers respectively.

Consumers made it known that clear communication and tech-driven food safety measures are increasingly relevant. One in three consumers (33%) say they’d be more likely to buy if a store displayed its in-store cleaning or food rotation schedules, and 28% say that signage about cleanliness routines increases their likelihood to purchase.

Tech-enabled food safety and task-tracking systems could sway even more: 12% said knowing this is happening would significantly increase their trust and willingness to buy hot or fresh food, while 17% said it would get them to consider options they usually avoid. Another 40% said it might help, but only if combined with other visible signs of cleanliness or other proof that it’s being followed. This suggests a layered approach is most effective: operational systems for automated fresh item, food safety and task technology with in-store transparency to build credibility and confidence at every step of the purchase journey.

Conclusion

This survey’s findings reveal a promising path forward. While some skepticism about gas station and convenience store food persists, many consumers are curious and open to changing their shopping habits. Shoppers are clear about what earns their trust—from fresh, high-quality food to clean environments and clear safety cues. Even those who are hesitant today can become loyal customers when they see consistent standards, recognizable brands, and a visible commitment to food safety. The opportunity is there for retailers ready to meet the moment.

For convenience retailers, that trust-building process starts at the front line. The associates who stock the shelves, prep the food, and interact with customers have the greatest influence on whether shoppers feel safe making a purchase. Equipping these teams with the right real-time data insight, task automation and food safety management tools ensures that quality and safety standards are consistently met and clearly communicated to the customer.

“In today’s competitive foodservice landscape, empowering frontline c-store workers to deliver confidence at every touchpoint isn’t just operationally smart. It’s essential to growing long-term trust and loyalty,” said Purna Mishra, Founder and CEO, Logile. “That’s why it’s critical to equip associates with the processes and systems they need to maintain rigorous food safety protocols, consistent delivery of quality fresh foods, and a clean, well-maintained environment. With tools like automated temperature monitoring, real-time task alerts, cleaning checklists and fresh item inventory insights, associates become the driving force behind a safer, smarter and superior in-store experience."

A Smarter Layer of Protection

Logile offers food safety solutions that automate and strengthen in-store practices with advanced tools for food retailers. Convenience store operations can benefit from Thermal IntelligenceTM (TI) to automatically monitor both hot and cold food temperatures more accurately than ambient air readings. Using thermal inertia-powered wireless sensors, TI minimizes manual checks, preserves product quality, and helps ensure compliance with real-time alerts when thresholds are breached. Combined with Logile’s other automated, task-based fresh item and food safety tools, food retailers gain greater consistency, visibility and control across all locations. Learn more at www.logile.com.

Survey Methodology

Logile used the third-party survey platform Pollfish to conduct an online survey of 1,000 U.S. consumers aged 18+ in April 2025. Researchers reviewed all responses for quality control.

Recent Posts

How Technology Enables Retailers to Invest in Community-Centric In-Store Experiences

2026-01-05

Community programs need operational precision to succeed. See how Lowes Foods' Community Table thrives with AI-driven labor planning that creates capacity for connection.

Read More

NRF 2026 Guide: Top Trends Shaping the Future of Retail and What to Expect From Logile

2025-12-15

Logile celebrates 20 years at NRF 2026 with AI-powered workforce solutions. Visit Booth #4849 & #1503 to see how connected operations drive retail success.

Read More

UK Retail Budget 2025: What Retailers Need to Respond to Now

2025-12-02

The 2025 UK Budget is reshaping retail economics. Rising labour costs, higher rates, tighter margins—here's what retail leaders must prioritize now.

Read More